Analyzing the Art Market in today’s world.

As you can imagine, I’m getting a lot of questions about where the art market is today and what's happening in the context of the larger world and the larger economy. And the answer is that I don't really look at the art market as a singular thing; I don't look at in terms of how it's connected with maybe a larger economic situation.

I look at it as a series of singular opportunities: that could be an opportunity on a specific artist market, that is a great practice that is undervalued. It might be on a singular work at any given time or perhaps in some other way, that's a small micro-market.

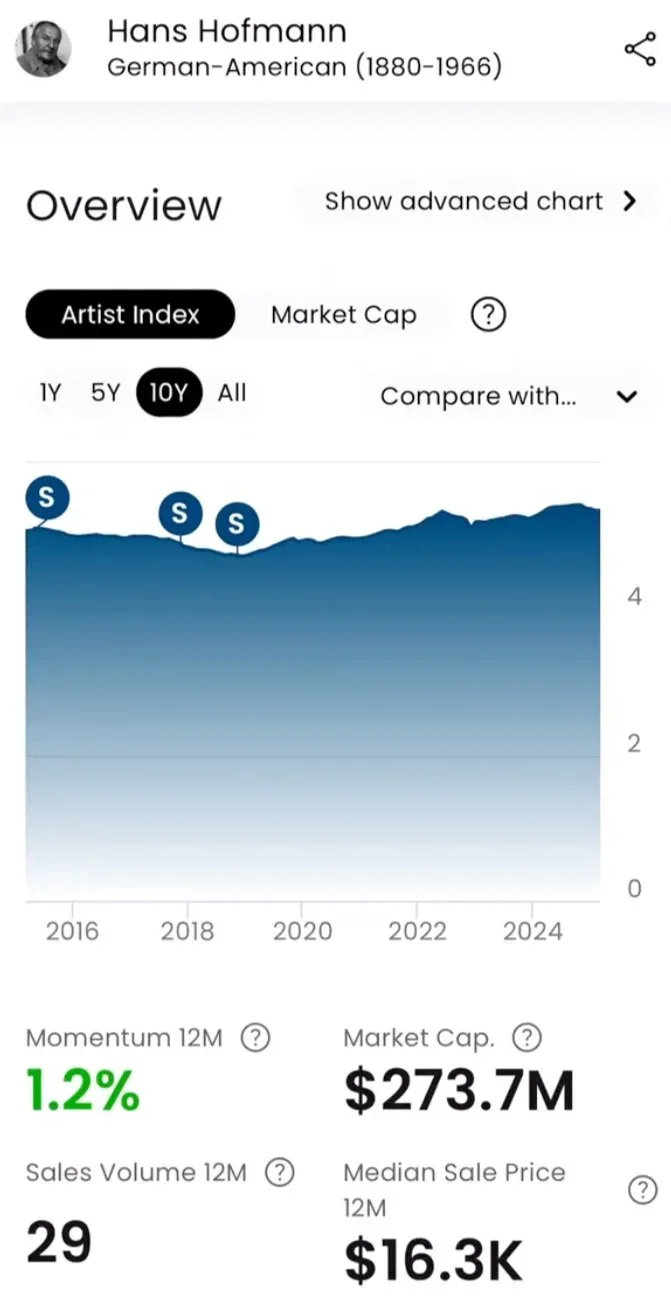

For example, in 2021, the market was super overheated because everyone wanted figurative work. This meant Hans Hofmann’s market was not so good at the time, people were looking at other things. But there is a fantastic 1964 Hofmann called Snow White that came up at Phillip’s in their day sale. I was able to buy that for a client for one bid.

And when everyone is looking one way,

sometimes it is helpful to look the other way.

Another example of that is, in 2019 the market was pretty good, in general, but not so great for David Hockney. There was a fantastic 1990’s painting called What About the Caves that popped up at Sotheby’s in their Evening Sale in London. I flew over and again, bought that painting for one bid. You could tell that that was a great painting for an artist that’s immensely famous, and his market has grown leaps and bounds today and really rebounded from where it was in 2019. That painting that I bought in 2019, today is worth 2.5 times what we bought it for.

It’s an idea of market feel and understanding where the opportunities are, but also where things might be going in the future. And in my practice as n art advisor, I will be doing the exact same thing: Where can I buy great art for great prices and build great collections?